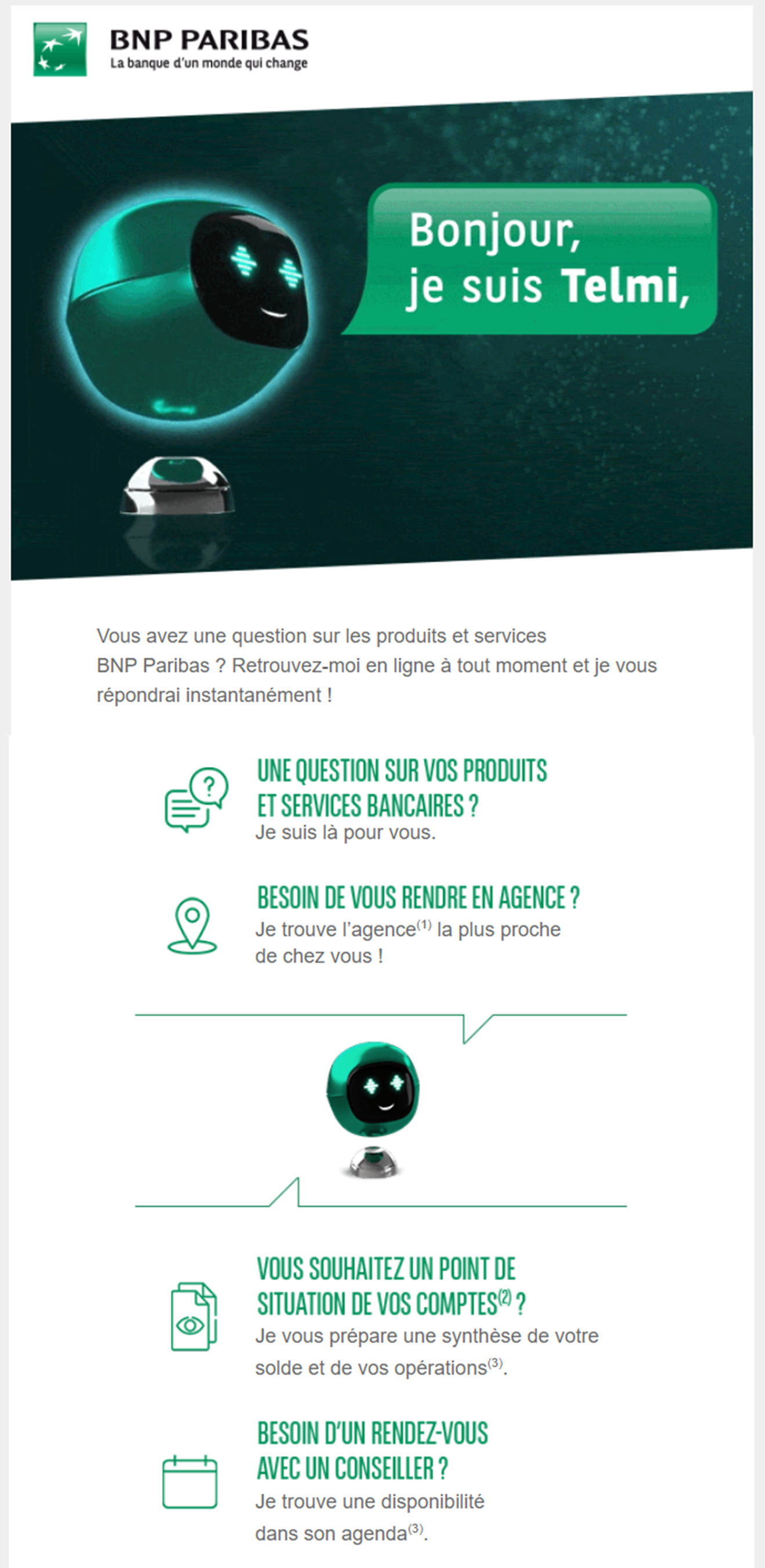

On November 25th, one of France’s largest banks, BNP, launched a digital assistant to help customers with their questions. As one of the oldest banks in France, founded in 1848, it is viewed as somewhat outdated and behind with the times. Through the use of the Telmi chatbot, the bank likely hopes to improve the image of the bank while also improving the operations of the company.

There are many advantages to using a chatbot representative for a large company : riding the obsession with small bots, bonus points for the play on words with the name, and reducing waiting time on the phone by filtering out the simple requests. All of these benefits will lead to higher customer satisfaction and thus higher retention and word-of-mouth growth.

Despite the many potential advantages, there are also several potential pitfalls that will result if the product is subpar. If the chatbot is not capable of understanding the user intent and therefor cannot provide a relevant or meaningful response, the client is likely to get very frustrated and the chat bot initiative would have missed the mark. That being said, a chatbot will clearly not be able to take care of all user queries. As a result, the chatbot should also be programmed to understand when the client should be transferred to a live agent. If the client is transferred too early, the benefits of the chatbot are not leveraged sufficiently and phone wait times remain high. If the client goes in circles with the chat bot and is transferred to a representative too late, the bank’s image will suffer.

BNP seems to not only have taken the above considerations into account but the bank has gone a step further by integrating the chat bot with Google Assistant. By integrating the chatbot into a home voice assistant service, the company is brining the chat bot to life and making it part of the family. This helps to create a bond between the client and the user, thereby increasing customer loyalty. From my experience, though, this approach is rather risky as most of Telmi’s responses to questions are website redirects. While this is very useful while on the phone or on the computer, it is less helpful when using a voice assistant. That being said, the client could easily use the two channels for different reasons: the voice assistant to get info on account and schedule meetings while the phone chatbot to get answers to more open ended questions.

Would you be willing to interact with your bank in this way? Would this additional service change your perception of the bank?